What Are The Best Budgeting Apps?

In this article, we offer insights into the best budgeting apps so you can make an informed decision and start your saving journey

In the age of smartphones, personal finance has been revolutionised by a wide range of money-managing apps. Designed to help us manage our finances more effectively, these tools offer features ranging from savings pots and expense tracking to stocks and investment management. They can also be a great help in budgeting for hobbies that quickly rack up in price when we're not being careful, such as gaming, reading and outdoor activities. But with so many options available, which one should you choose?

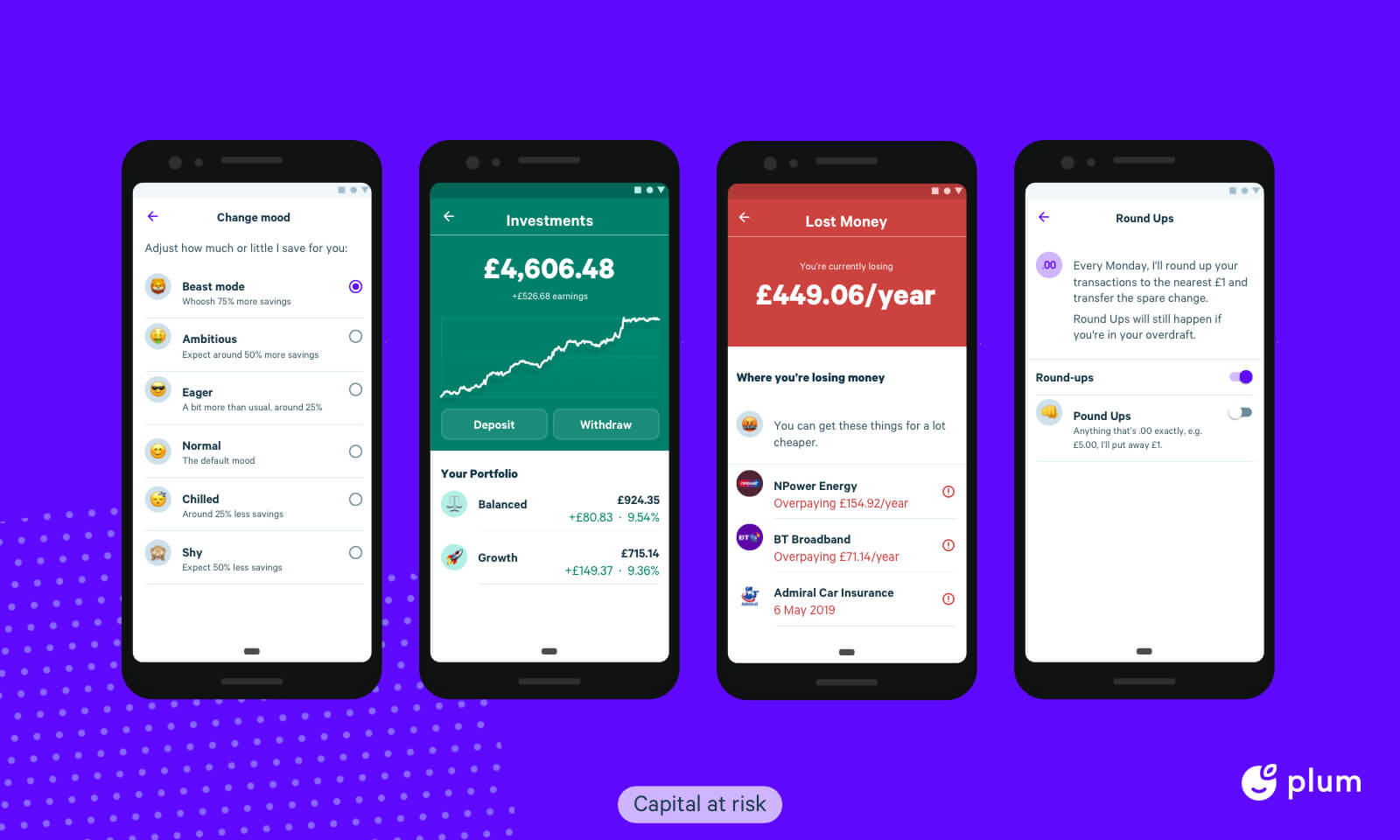

Plum

Plum is a UK-based financial services company offering an app to automate user savings and investments. The app safely connects to your bank account using open banking technology.

It uses artificial intelligence to analyse your spending and saving habits. It suggests saving and investment levels that are unique to you. You can set these suggestions to be as frequent. The basic version is free, but there are options for paid accounts with extra benefits.

- FSCS Protected

- FCA Regulated

- A Free Plan

- Savings Goals

- Automated Investments

Free | Pro £2.99/month | Ultra £4.99/month |

|---|---|---|

Automatic Deposits | Automatic Deposits | Automatic Deposits |

Round Ups | Round Ups | Round Ups |

3.82% Interest on savings | 4.29% Interest on savings | 4.44% Interest on savings |

Investments | Investments | Investments |

Personal Pensions | Personal Pensions | Personal Pensions |

1 Interest Pocket | 15 Interest Pockets | 15 Interest Pockets |

X | Pocket Goals | Pocket Goals |

X | Cashback | Cashback |

X | 12 Mutual Funds | 12 Mutual Funds |

X | X | Priority Customer Support |

X | X | Automatic Investments |

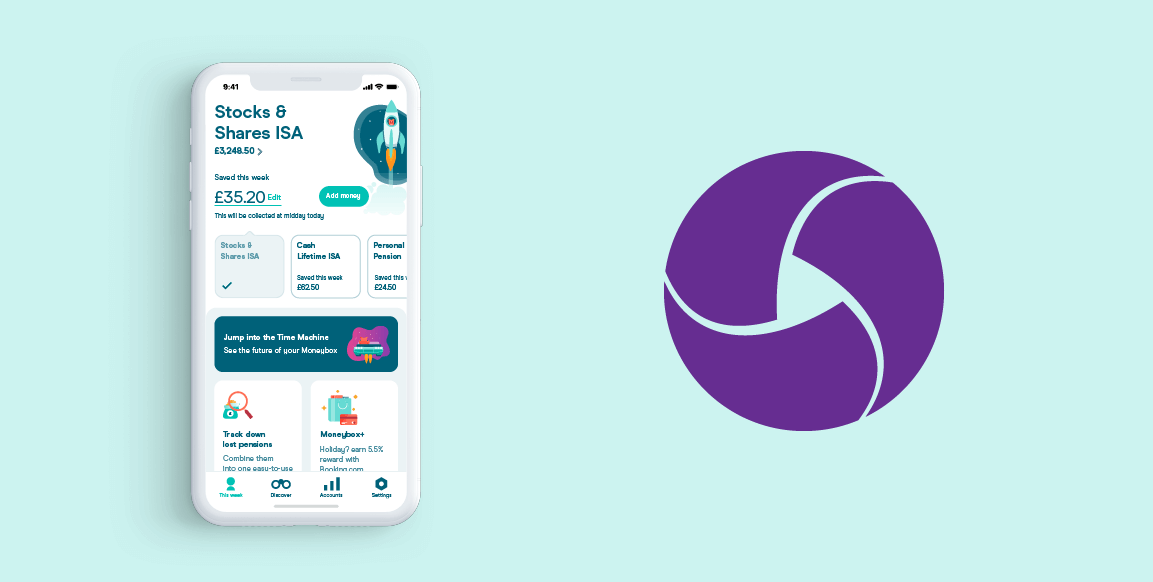

Moneybox

Moneybox is a free personal finance app that makes it easier for people to invest in their future. It taps into the concept of “micro-investing”, making the world of investments more accessible to everyone. One of Moneybox’s standout features is its integration with everyday transactions. The round-up feature encourages a saving habit that you barely notice, making it a painless way to build up a pot.

The app offers three simple investment options: Cautious, balanced and adventurous. This simplifies the usually complex decision-making process associated with investing. Your savings can be added to several account types, including general investment, Stocks & Shares ISA and Junior ISAs, each with its benefit or government incentive. However, all forms of investment carry risks, which is important to note before diving in. Moneybox is a free finance app in the sense that there is no upfront cost or subscription, they do, however, take a tiny percentage of your earnings, the fees I paid equated to around £1.50 to £2 of my earnings each month, which was barely noticeable.

- Moneybox Pensions

- Mortgage advice

- Earn interest

- Round up spending into saving pot

- Deposit and savings calculators

- FSCS Protection

- Stress-free investing

- Government incentives

- FCA regulated

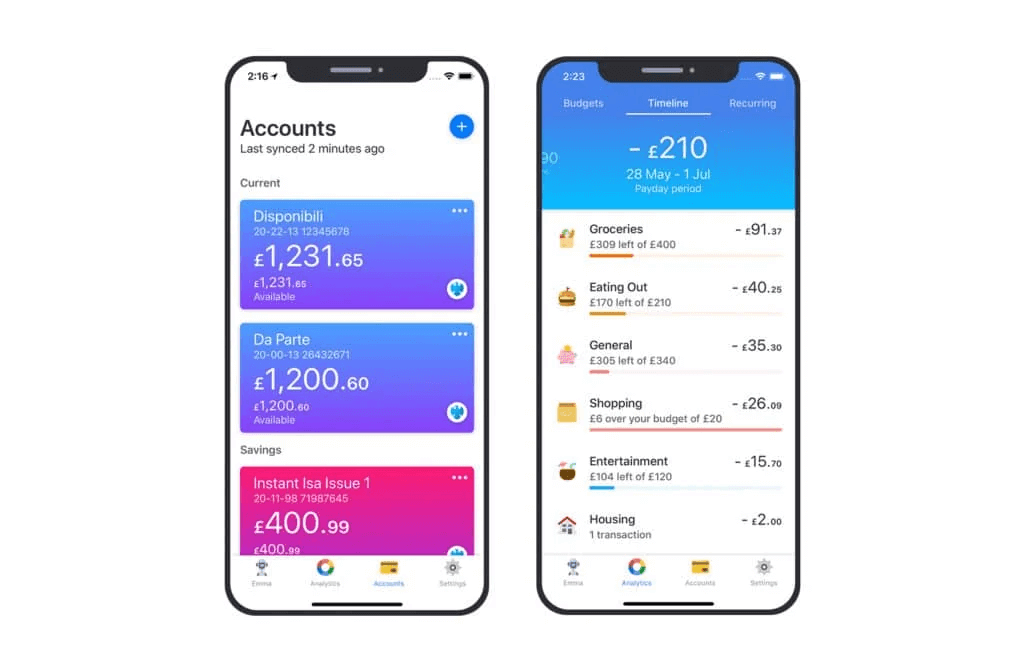

Emma

Emma is a comprehensive money management app designed to help users manage their finances. It is a budgeting tool, financial tracker, and savings assistant in one place that provides a clear view of their financial situation. One of Emma's greatest strengths is its ability to link multiple banks and accounts. Your transactions and balances are shown in one place, making tracking spending habits and budget easy.

Emma automatically categorises transactions, making it easy to see where your money goes monthly. It also has a subscription tracking service that identifies recurring payments, ensuring you know all your commitments and helping you cut back on subscriptions you no longer use. However, all this comes with a small cost. Emma does have a free plan, but to get the total value out of the app, you need to choose from three subscription plans ranging from £4.99 to £14.99.

- £30 free for each referred friend that joins.

- FCA regulated

- FSCS protected savings

- Set and track budgets

- Invest

- Get Cashback at 500+ retailers

Free | Plus £4.99/month | Pro £9.99/month | Ultimate £14.99/month |

|---|---|---|---|

Combine Accounts | Combine Accounts | Combine Accounts | Combine Accounts |

Payday Tracking | Payday Tracking | Payday Tracking | Payday Tracking |

Monthly Budgets | Monthly Budgets | Monthly Budgets | Monthly Budgets |

Subscription Tracker | Subscription Tracker | Subscription Tracker | Subscription Tracker |

X | Cashback | Cashback | Cashback |

X | Priority Support | Priority Support | Priority Support |

X | Bill Reminders | Bill Reminders | Bill Reminders |

X | Fraud Detection | Fraud Detection | Fraud Detection |

X | Custom Icons | Custom Icons | Custom Icons |

X | Pay Bills & Transfers | Pay Bills & Transfers | Pay Bills & Transfers |

X | X | Savings Goals | Savings Goals |

X | X | Split Transactions | Split Transactions |

X | X | Custom Categories | Custom Categories |

X | X | Net Worth Calculator | Net Worth Calculator |

X | X | Rolling Budgets | Rolling Budgets |

X | X | X | Business Accounts |

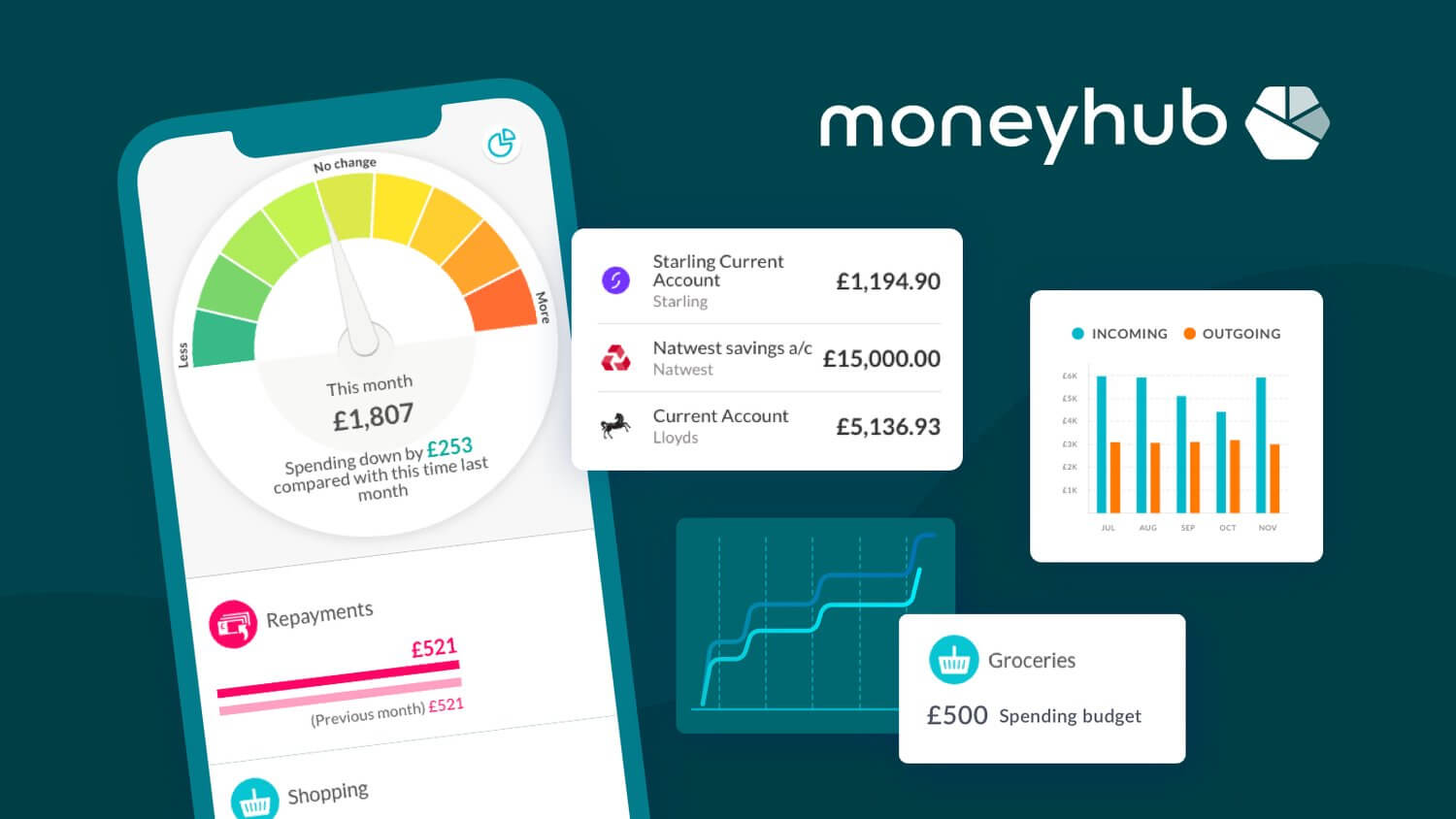

Moneyhub

Moneyhub is a comprehensive financial management app. From budgeting and spending to investment monitoring, many features are designed to help users gain control of their finances. The app can combine all your bank accounts under one account, providing a unified view. Then once linked, Moneyhub also categorises your transactions for easy budgeting, allowing you to set individual budgets for each.

You can also connect investment accounts on the app to track performance and receive insights. This feature could be a game changer for more seasoned investors. However, Moneyhub does cost £1.49 or £14.99 a year which is reasonable considering the perks.

- Spending goals

- Forecasting

- Nudges before payments are made

- Spending Analysis

- Access to Financial Advisors

- FCA regulated

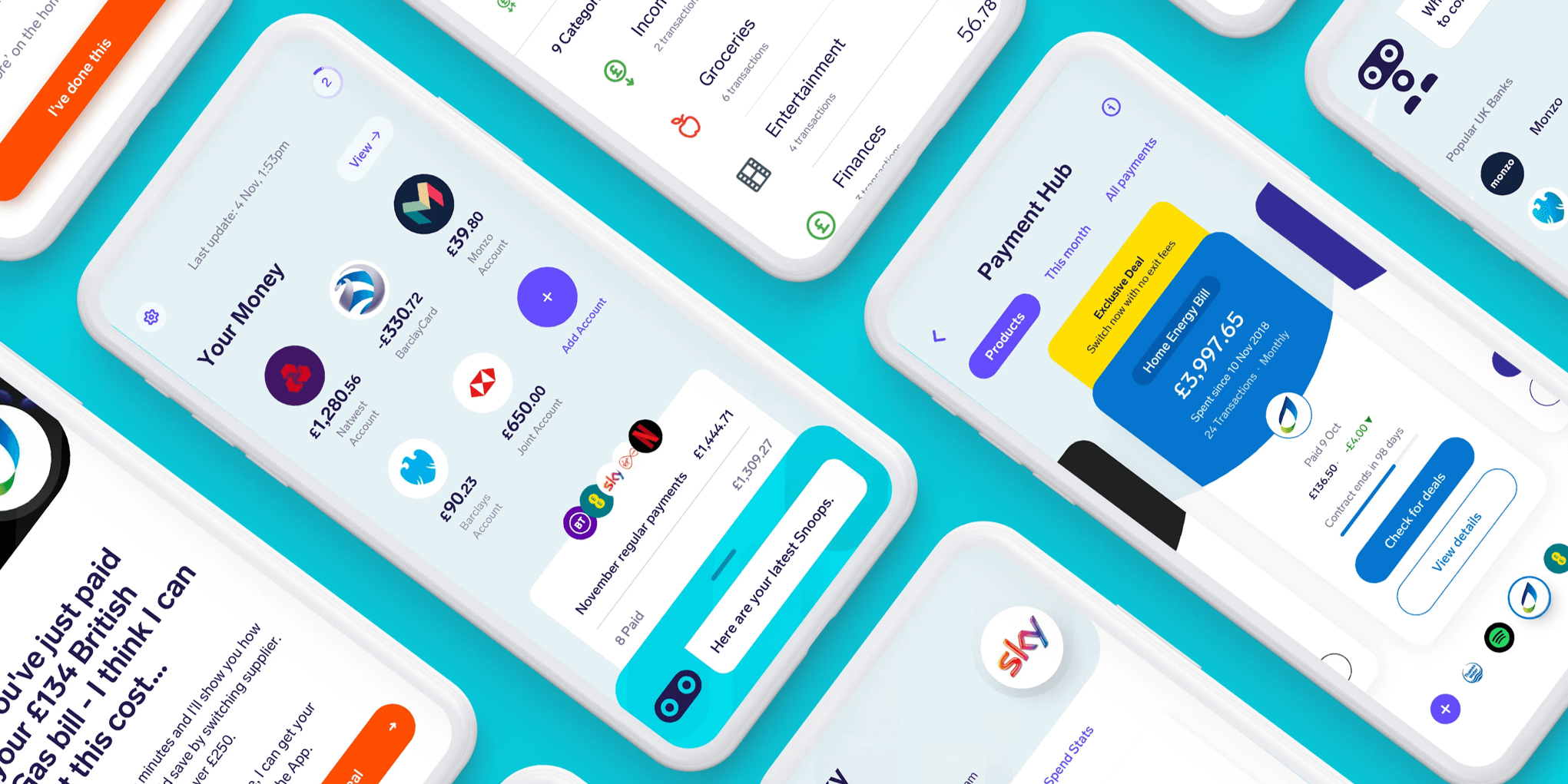

Snoop Finance

If you find managing your money a bit of a chore, the Snoop Finance app could be a game-changer. It’s designed to take all the hassle out of budgeting by linking securely to your bank accounts, giving you a clear view of where your cash goes and where you can save. No complicated set-ups, no fiddly spreadsheets, just instant insights that help you spot overspending or unwanted subscriptions.

What makes Snoop one of the best free budgeting apps out there is its personalised money tips. It’ll nudge you towards deals and offers that fit your lifestyle, whether you’re looking to cut down on bills or squirrel away more savings each month. It’s straightforward to use, even if you’re not a tech wizard. If you’re eager to keep your finances on track and free up some extra cash, Snoop Finance is well worth checking out.

- Voted Innovation of the Year 2021 by the British Bank Awards

- Free to use

- Connects with existing bank account

- Track credit score

- Set and track budgets

- Find vouchers and sales

- FCA regulated

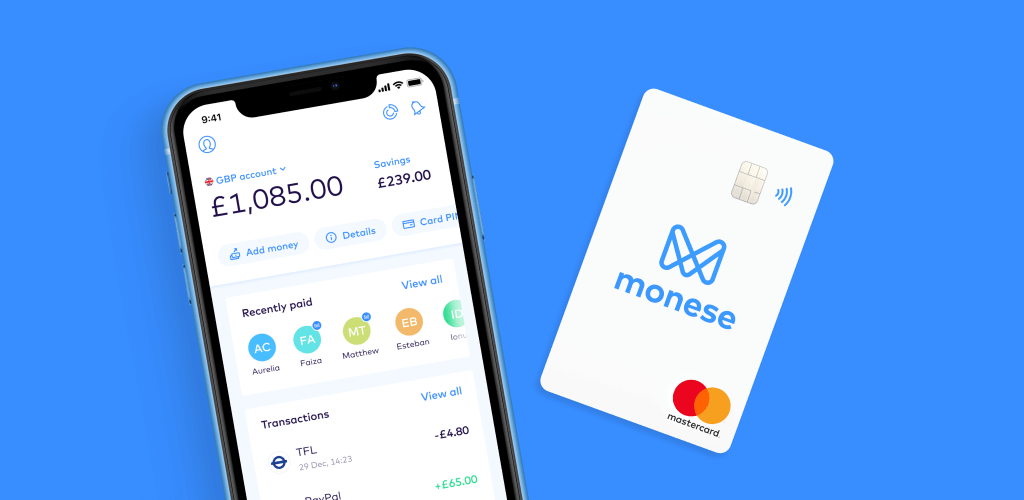

Monese

If you’re after a simple, all-in-one way to manage your money, Monese is one of the top budgeting apps and could be just what you need. Setting up an account is quick and easy, even if you’re new to the UK, and everything runs through an easy app that helps you stay on top of your finances.

From tracking day-to-day spending to getting instant notifications whenever you use your card, Monese does the heavy lifting so you can see exactly where your money goes. You can also set up budgets and savings pots, making meeting your goals simpler and avoiding any nasty surprises. Plus, it’s super handy if you travel or shop online, with multi-currency options to help you dodge high conversion fees. If you want a clear, straightforward tool to keep your finances in check, Monese is one of the best free budgeting apps and definitely worth a look.

- Set and track budgets

- Save money in pots

- Connect with Apple Pay

- Free option

- PayPal integration

- Round ups

There are plenty of good budgeting apps out there and each of the above apps have unique strengths and weaknesses that will appeal to different types of users. It is also worth noting the above apps are just there to assist you in making money management more straightforward; they cannot do it for you.

Looking for more ways to save? Check out our guide to saving money with reward schemes.

I started at MyVoucherCodes as a Deal Expert, sourcing top deals and discount codes. I combined these skills with my passion for writing to become an Editor, helping readers save money. As a former student and homeowner, I understand the need to budget and provide shopping tips, especially for vegetarian and vegan diets. I've also written for publications like GamesRadar+, Tom's Guide, Tom's Hardware, The Sun, My Weekly, iPaper and Pick Me Up!

I play video games, write reviews for GameReport in my spare time, and love trying out the latest tech gadgets. I also enjoy DIY projects, having worked in a tool store and renovated my home on a budget.