State Pension rise likely from April 2026 under new triple check

New state pension uplift likely in 2026; pensioners should double-check their resources and eligibility

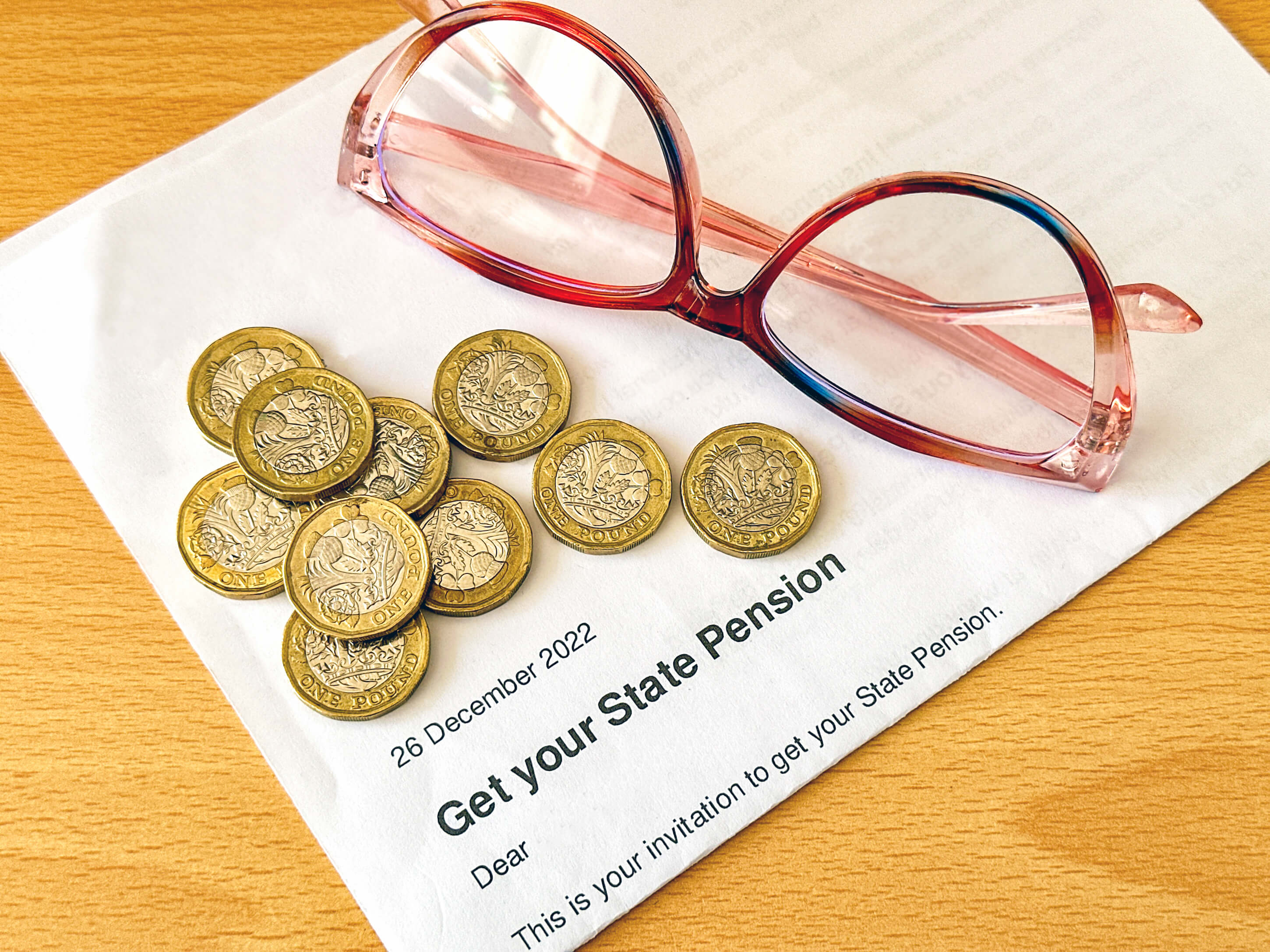

UK wage data out today points to a state pension uplift next April. Average earnings grew by 4.8% in the three months to July 2025, excluding any bonuses, and 4.7% including bonuses, according to the ONS.

Under the triple lock, the State Pension rises by the highest of earnings, September CPI inflation, or 2.5%. The exact rate is confirmed after the September inflation figures are published.

For money-saving readers, the priority is to ensure you receive everything you are entitled to and that routine bills are managed sensibly around any rise.

Start with the basics. Check your State Pension forecast on GOV.UK and review your National Insurance record in the UK to check for gaps that could reduce your benefits.

If you do have missing years, the government advises contacting the Future Pension Centre before paying voluntary class 3 contributions, so you only top up years that actually increase your pension.

If your income is modest, Pension Credit can boost your weekly income and open the door to other support. You can check eligibility and apply online or by phone. You can also contact Citizens Advice online or via 0808 223 1133 for advice on everything you can claim.

Energy help returns for winter. The Warm Home Discount is due to return in October 2025, with the government confirming plans to widen eligibility in England and Wales for 2025-2026.

Most eligible households in England and Wales are identified automatically. In Scotland, some people apply via their supplier. The Winter Fuel Payment of £100-£300 is paid automatically to most who qualify. If you rely on extra help with utilities, ask to join your suppliers' Priority Services Register.

Council bills are another area to check. If you live alone, you can get a 25% Council Tax single person reduction. If you are on a low income, Council Tax Reduction can cut bills further, in some cases up to 100% depending on local rules.

There are everyday travel and household savings, too. The Senior Railcard gives 1/3 off most rail fares for those aged 60 and over. Couples where one partner pays no tax can look at the Marriage Allowance, which lets you transfer part of a personal allowance to a basic-rate-paying spouse or civil partner, reducing their tax bill.

If broadband or phone costs are high, ask about social tariffs. Ofcom keeps an up-to-date list of low-cost packages for people on certain benefits.

Note: This article is general information, not financial advice. Check details on GOV.UK or speak to Citizens Advice if you are unsure.

I started at MyVoucherCodes as a Deal Expert, sourcing top deals and discount codes. I combined these skills with my passion for writing to become an Editor, helping readers save money. As a former student and homeowner, I understand the need to budget and provide shopping tips, especially for vegetarian and vegan diets. I've also written for publications like GamesRadar+, Tom's Guide, Tom's Hardware, The Sun, My Weekly, iPaper and Pick Me Up!

I play video games, write reviews for GameReport in my spare time, and love trying out the latest tech gadgets. I also enjoy DIY projects, having worked in a tool store and renovated my home on a budget.